Albert

Budgeting and Banking

Description of Albert: Budgeting and Banking

THE ALL-IN-ONE MONEY APP

Budget, save, spend, and invest — all in one incredibly powerful app. Get 24/7 identity monitoring, earn on your savings, and ask our finance experts anything. Subscription required. Try 30 days before you’re charged.

ONLINE BANKING

Set up direct deposit and get paid up to 2 days early. Earn cash back at select stores. Albert is not a bank. See disclosures below.

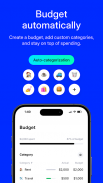

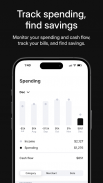

BUDGETING AND PERSONAL FINANCE MANAGEMENT

Get a monthly budget, track expenses, and use planning tools to customize your spending plan. See all your accounts in one place and track recurring bills. We’ll help find subscriptions you don’t use and negotiate to lower your bills.

AUTOMATIC SAVING AND INVESTING

Smart money automatically transfers money to your Albert Savings and Investing accounts throughout the week. Open a high yield savings account to earn competitive APY on your deposits, over 9x the national average. Invest in stocks, ETFs, and managed portfolios. See disclosures below.

PROTECT YOUR MONEY

24/7 monitoring on your accounts, credit, and identity. Get real-time alerts when we detect potential fraud. Plus, track your credit score over time.

DISCLOSURES

Albert is not a bank. Albert Cash banking services provided by Sutton Bank, Member FDIC. Albert Savings accounts are held for your benefit at FDIC-insured banks, including Coastal Community Bank, and Wells Fargo, N.A. The Albert Mastercard® debit card is issued by Sutton Bank, pursuant to a license by Mastercard. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Funds in Albert Cash are held in a pooled account at Sutton Bank. Funds in Savings accounts are held at Coastal Community Bank or Wells Fargo, N.A., disclosed on account opening. Cash and Savings account funds are eligible for up to $250,000 in FDIC insurance on a pass-through basis. Your FDIC insurance is subject to specific conditions being satisfied.

Albert plans range from $11.99 to $29.99. Try 30 days before you're charged. The fee will auto-renew until canceled or your Albert account is closed. Cancel in the app. See Terms of Use and Account Agreement for more details, including fee information.

The Instant Advance is available to you at Albert’s discretion. Limits range from $25-$250, subject to eligibility. Not all customers will qualify. Transfer fees may apply.

Early access to direct deposit funds may vary depending on the payer’s deposit timing.

Cash back rewards are subject to Terms of Use.

For High Yield Savings accounts, interest rates are variable and subject to change at any time. These rates are current as of 12/19/24. There is no minimum balance requirement. Genius is required to access High Yield Savings. Fees to use Albert may reduce the earnings on your account.

Brokerage services provided by Albert Securities, member FINRA/SIPC. Investment advisory services provided by Albert Investments. Investing accounts are not FDIC insured or bank guaranteed. Investing involves the risk of loss. More info at albrt.co/disclosures.

Credit score calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian® indicates your credit risk level and is not used by all lenders, so don't be surprised if your lender uses a score that's different from your VantageScore 3.0.

The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits at albrt.co/id-ins.

Address: 440 N Barranca Ave #3801, Covina, CA 91723

No customer support available at this address. Visit www.albert.com for customer support details.

Not affiliated with personal finance budget apps such as Rocket Money, Everydollar, Monarch Money, Quicken Simplifi, Pocketguard, Copilot or Nerdwallet.